WEDNESDAY, APRIL 5, 2017

How can you recuperate after a significant infraction of your driving privileges? Being unable to drive can make like difficult for many people. How can you recuperate after a significant infraction of your driving privileges? Being unable to drive can make like difficult for many people.

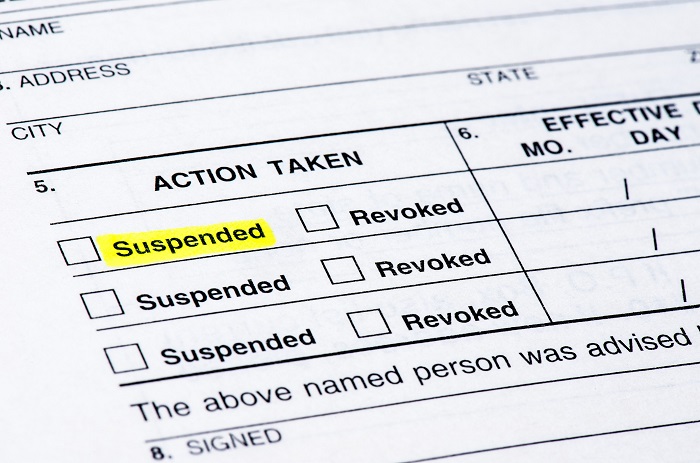

If you've had too many tickets or a reckless driving incident, the Texas Department of Public Safety may suspend your driving privileges. When this happens, it is generally for a specified period of time — such as 30 or 90 days. In most cases, you can get your license back once the suspension is up. But, what happens with car insurance at that time?

What Insurers Want To Know

If you can drive after your suspension ends, auto insurance agents are likely to offer you a policy. However, the amount you'll pay for that car insurance will differ from one person to the next based on risk. If you are a high-risk driver, you'll likely pay more.

Most DMVs will also require the use of an SR-22. This is a certificate you will need to carry in order to prove to the court you have liability insurance. The need for an SR-22 can indicate your status as a high-risk driver, which can increase your costs. Most SR-22 requirements are in effect for three to five years.

During the time you're carrying an SR-22 certificate, you must continually prove to your auto insurance company that you're a trusted, safe driver. To do this, keep the following tips in mind.

- Avoid any reckless driving charges. To do this, drive the legal posted speed. Avoid aggressive driving. And take your time to avoid any type of violation.

- Avoid accidents. If you are in a situation where there is a risk of an accident, such as poor driving conditions, pull over and wait. Don't risk it.

- Consider taking a driving course. Many times, your auto insurance provider will offer a lower premium if you complete a course. Talk to your insurer about these courses before signing up for one.

It is possible to get auto insurance after a license suspension. And, if you remain incident free afterwards, you'll notice your costs will likely begin to fall. After all, everyone makes a mistake from time to time.

However, it takes a lot of hard work to get back on track. Invest in the right auto insurance for your situation and then keep up with your coverage. Maintain any SR-22 requirements as well. These steps can help you to save money in the long term.

HIG – Henrich Insurance Group is here to help you get coverage. We will build a policy that is correct for you. Call us at (713) 349-0400 for a free Houston car insurance quote.

No Comments

Post a Comment |

|

Required

|

|

Required (Not Displayed)

|

|

Required

|

All comments are moderated and stripped of HTML.

|

|

|

|

|

|

NOTICE: This blog and website are made available by the publisher for educational and informational purposes only.

It is not be used as a substitute for competent insurance, legal, or tax advice from a licensed professional

in your state. By using this blog site you understand that there is no broker client relationship between

you and the blog and website publisher.

|

Blog Archive

2020

2018

2017

2016

2015

2014

2013

2012

2011

2010

|